As Shark Tank India Season 5 premiered on January 5, 2026, audiences were captivated not just by the innovative startups and high-stakes pitches, but also by the incredible wealth of the judges themselves. Understanding the net worth of these business titans provides fascinating insight into how successful entrepreneurs build empires and make strategic investments. This comprehensive article explores the estimated net worth of all Shark Tank India Season 5 judges, revealing who stands at the top of the wealth hierarchy and what makes their fortunes so remarkable.

Understanding Shark Tank India & Its Global Impact

Shark Tank India is the Indian adaptation of the internationally renowned business reality show format where aspiring entrepreneurs pitch their startup ideas to a panel of wealthy investors (called “Sharks”). The show has become a cultural phenomenon in India, fundamentally transforming how young people perceive entrepreneurship and business creation. Since its launch, the show has facilitated over 700 business deals and created a blueprint for startup success in India.

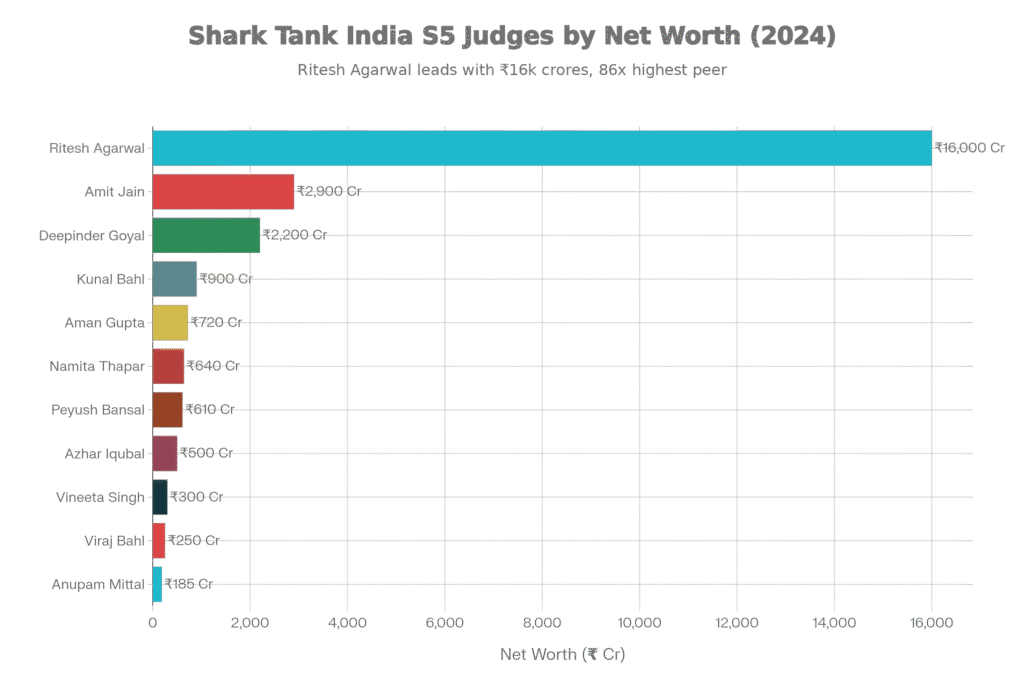

The judges selected for Shark Tank India represent the cream of India’s entrepreneurial ecosystem—self-made billionaires and multi-crore business magnates who have built companies across diverse sectors including hospitality, food delivery, pharmaceuticals, audio electronics, and matrimonial services. Their participation lends credibility to the show and provides aspiring entrepreneurs with mentorship from individuals who have navigated similar challenges. The combined net worth of all Shark Tank India Season 5 judges exceeds ₹27,000 crores, making it arguably the most prosperous panel of investors ever assembled on an Indian television program.

Complete List of Shark Tank India Season 5 Judges

Shark Tank India Season 5 features a refreshed panel combining returning judges with new faces representing emerging sectors of the Indian economy. The confirmed judges for this season are:

Returning Judges:

- Aman Gupta (boAt)

- Anupam Mittal (Shaadi.com)

- Namita Thapar (Emcure Pharmaceuticals)

- Vineeta Singh (SUGAR Cosmetics)

- Peyush Bansal (Lenskart)

- Ritesh Agarwal (OYO Rooms)

- Amit Jain (CarDekho)

- Kunal Bahl (Snapdeal)

- Viraj Bahl (Veeba Foods)

New Judges for Season 5:

- Deepinder Goyal (Zomato, Eternal Limited)

- Azhar Iqubal (Inshorts, Public App)

- Shaily Mehrotra (Fixderma India)

- Hardik Kothiya (Rayzon Solar)

- Mohit Yadav (Minimalist)

- Kanika Tekriwal (JetSetGo Aviation)

- Varun Alagh (Honasa Consumer Limited)

- Pratham Mittal (Masters’ Union & Tetra)

The expanded panel reflects the evolving nature of India’s startup ecosystem, with new judges bringing expertise in renewable energy, aviation, sustainability, and direct-to-consumer brands.

Criteria for Calculating Judge Net Worth

Net worth calculations for these judges are based on multiple factors including personal shareholding in their companies, valuations from recent funding rounds, public shareholdings for listed companies, real estate holdings, and investment portfolios. It’s crucial to distinguish between personal net worth and company valuations—a judge’s net worth represents their personal wealth, while their company’s valuation reflects the total value of the business.

For publicly listed companies like Zomato, net worth calculations are derived from stock holdings and current share prices. For private companies, valuations come from recent funding rounds or acquisition valuations. Angel investments and Shark Tank portfolio investments also contribute to personal net worth but represent a smaller percentage of overall wealth for most judges.

Judge-by-Judge Net Worth Breakdown

Ritesh Agarwal – The Youngest Billionaire & Richest Judge

Estimated Net Worth: ₹16,000 Crore (≈ $2 Billion USD)

Primary Source of Wealth: OYO Rooms (Founder & CEO)

Ritesh Agarwal stands as the undisputed richest judge on Shark Tank India Season 5, with a net worth that dwarfs all other panelists combined. Born on November 16, 1993, Agarwal is India’s youngest billionaire entrepreneur, having founded OYO Rooms at just 19 years old in 2013. What began as Oravel Stays, a budget accommodation platform, evolved into a global hospitality chain managing over 1.5 million rooms across 80+ countries.

OYO’s current valuation stands at approximately ₹74,000 crores ($9.6 billion), with Agarwal maintaining significant controlling interests. The company’s upcoming IPO targets a valuation of $7-8 billion, which will further solidify his billionaire status. Beyond OYO, Ritesh has diversified his investment portfolio across multiple startups including Cars24, Magicpin, and Unacademy, each contributing to his wealth accumulation. His investments reveal a keen eye for identifying scalable technology-driven businesses with global potential.

Amit Jain – The Second-Richest Judge

Estimated Net Worth: ₹2,900 Crore (≈ $350 Million USD)

Primary Source of Wealth: CarDekho, InsuranceDekho (Co-Founder & CEO)

Amit Jain is an IIT alumnus who co-founded CarDekho, which has evolved into India’s leading automotive technology unicorn. The platform revolutionized India’s auto-tech ecosystem by creating a comprehensive digital marketplace for vehicle buying, selling, and financing. CarDekho’s success led to the launch of InsuranceDekho, extending the company’s reach into financial services. Jain’s data-driven investment approach on Shark Tank India emphasizes sustainable unit economics and long-term scalability, reflecting his experience building resilient tech platforms.

Deepinder Goyal – The Food & Tech Entrepreneur

Estimated Net Worth: ₹2,200 Crore (≈ $265 Million USD)

Primary Source of Wealth: Zomato (Co-Founder & CEO)

Deepinder Goyal revolutionized India’s food and logistics sector through Zomato, which he founded in 2008 as a restaurant review platform before pivoting to food delivery. An IIT Delhi graduate, Goyal transformed Zomato into India’s largest food delivery application with market penetration in over 1,000 Indian cities. Zomato’s 2021 IPO at a $13 billion valuation marked a watershed moment for Indian tech startups. The company’s diversified ecosystem—including Blinkit (quick commerce), restaurant supply chain services (Hyperpure), and dining events (Zomaland)—generates substantial recurring revenue. As of 2025, Zomato’s market capitalization has grown to approximately ₹2.35 lakh crores, though Goyal’s personal ownership percentage remains lower than Ritesh’s OYO stake, resulting in a more modest net worth relative to the company’s size.

Kunal Bahl – The E-Commerce Pioneer

Estimated Net Worth: ₹900 Crore (≈ $108 Million USD)

Primary Source of Wealth: Snapdeal (Co-Founder), Titan Capital (Managing Partner)

Kunal Bahl co-founded Snapdeal, an e-commerce marketplace that became India’s largest platform for consumer electronics and daily essentials. Despite intense competition from Flipkart and Amazon, Snapdeal carved a niche in the market. Bahl’s wealth also stems from his role as managing partner of Titan Capital, an early-stage venture fund that has invested in numerous successful Indian startups. His experience navigating the volatile e-commerce landscape makes him an invaluable mentor for logistics, supply chain, and technology-focused entrepreneurs on Shark Tank India.

Bigg Boss Tamil Season 9 Vote Update: Latest Voting Trends, Who Is Safe & Who Is in Danger Zone

Aman Gupta – The Audio & Wearables Magnate

Estimated Net Worth: ₹720 Crore (≈ $86 Million USD)

Primary Source of Wealth: boAt (Co-Founder & CMO)

Aman Gupta transformed India’s consumer electronics market by identifying a critical gap between expensive imported audio brands and low-quality affordable options. Founded in 2016, boAt has grown into a ₹10,500 crore valued company specializing in earphones, headphones, smartwatches, and portable speakers. Gupta’s D2C (direct-to-consumer) marketing strategy and focus on trendy designs at Indian-friendly prices resonated powerfully with young consumers. Beyond boAt, Gupta has made approximately 87 angel investments through Shark Tank India, including a remarkable ₹12 lakh investment in Let’s Try (a snack brand) that appreciated to ₹40 crores—representing a 333x return. This success story has made Gupta one of Shark Tank India’s most prolific and successful angel investors.

Namita Thapar – The Pharmaceutical Executive

Estimated Net Worth: ₹640 Crore (≈ $76 Million USD)

Primary Source of Wealth: Emcure Pharmaceuticals (Executive Director)

Namita Thapar is the Executive Director of Emcure Pharmaceuticals, a global pharmaceutical company founded by her father. The company specializes in women’s health, oncology, and specialty medicines, with operations across multiple continents. Thapar’s wealth is primarily derived from her significant shareholding in the family-controlled pharmaceutical enterprise. Her focus on healthcare and women-centric businesses on Shark Tank India reflects her professional expertise and personal entrepreneurial philosophy. Thapar is known for her forthright assessments and willingness to decisively say “I’m out” when businesses don’t align with her investment criteria.

Peyush Bansal – The Vision Tech Entrepreneur

Estimated Net Worth: ₹610 Crore (≈ $73 Million USD)

Primary Source of Wealth: Lenskart (Co-Founder & CEO)

Peyush Bansal disrupted India’s optical retail sector by launching Lenskart, a technology-enabled eyewear e-commerce platform that made quality glasses and contact lenses accessible and affordable. Before launching Lenskart, Bansal worked at Microsoft USA, bringing valuable international tech experience to his entrepreneurial venture. Lenskart’s omnichannel retail presence, combining online platforms with physical stores across major Indian cities, demonstrated a scalable business model. Bansal’s focus on customer-first innovation and sustainable growth strategies influences his investment decisions on Shark Tank India, where he often seeks founders with visionary long-term thinking.

Azhar Iqubal – The News Tech Innovator

Estimated Net Worth: ₹500 Crore (≈ $60 Million USD)

Primary Source of Wealth: Inshorts, Public App (Co-Founder)

Azhar Iqubal joined Shark Tank India Season 5 as a new judge, bringing expertise in news technology and fintech. As co-founder of Inshorts, Iqubal made news consumption trendy for Gen-Z by creating bite-sized, readable news summaries. His newer venture, Public App, revolutionized stock market investing for Indian retail investors by simplifying investment processes. Iqubal’s young age (early 30s) and deep understanding of technology-driven, app-based business models bring fresh perspective to the Shark Tank panel, appealing particularly to Gen-Z founders.

Vineeta Singh – The D2C Beauty Pioneer

Estimated Net Worth: ₹300 Crore (≈ $36 Million USD)

Primary Source of Wealth: SUGAR Cosmetics (Co-Founder & CEO)

Vineeta Singh co-founded SUGAR Cosmetics, building it into a ₹500+ crore direct-to-consumer beauty brand that competes with international cosmetics giants. Her expertise in executing D2C strategies, supply chain optimization, and building premium brands at accessible prices makes her a valuable judge for beauty and consumer goods entrepreneurs. Notably, Vineeta is an ultramarathon runner, embodying the endurance and determination required in entrepreneurship.

Anupam Mittal – The Matrimonial Platform Pioneer

Estimated Net Worth: ₹185 Crore (≈ $22 Million USD)

Primary Source of Wealth: Shaadi.com (Founder & CEO)

Anupam Mittal founded Shaadi.com, which revolutionized India’s matrimonial sector by digitizing marriage broker services that were traditionally handled face-to-face. As the original Shark Tank India judge since Season 1, Mittal is the “thinking shark” known for asking penetrating logical questions and evaluating long-term business sustainability. Despite having a lower net worth compared to other judges, Mittal has made over 250 angel investments through Shark Tank India and other ventures, earning him the reputation of being the most active investor among all judges. His investments have generated some of the most impressive success stories in Shark Tank India history.

The Richest Judge: Detailed Analysis of Ritesh Agarwal’s Wealth

Ritesh Agarwal’s ₹16,000 crore net worth represents a staggering 7-fold difference from the second-richest judge (Amit Jain at ₹2,900 crore). His wealth accumulation journey offers valuable insights into building billion-dollar global enterprises at a young age.

Agarwal’s personal wealth is primarily concentrated in OYO Rooms, where he maintains significant founder shareholding. The company’s last private funding round valued OYO at $9.6 billion, and with his majority stake, Agarwal’s wealth directly correlates to OYO’s valuation changes. Beyond base equity, Agarwal’s diversified angel investments across the startup ecosystem add incremental wealth. His investments reveal a pattern of backing technology-enabled, capital-efficient businesses with global scalability potential—precisely the template he used to build OYO.

Fascinating Insights About Judge Wealth & Investment Patterns

Wealth-to-Investment Ratio: Contrary to expectations, net worth doesn’t always correlate directly with active investment on Shark Tank India. Anupam Mittal, despite having the lowest net worth among major judges, has made the most deals (250+), while Ritesh Agarwal, though wealthiest, invests more selectively in high-potential ventures. This reflects different investment philosophies—quantity versus quality approaches.

Highest Investment Ticket Sizes: Ritesh Agarwal made Shark Tank India’s largest deal ever—₹5 crore for 51% equity in NOOE (a lifestyle accessories brand), demonstrating his confidence in transformative investments. This deal size, unusual even by Shark Tank standards, reflects the confidence of a billionaire making strategic bets.

Best Investment Returns: Aman Gupta’s ₹12 lakh investment in Let’s Try snack brand, which appreciated to ₹40 crores, represents the highest documented return on investment in Shark Tank India’s history—a remarkable 333x return. This success story demonstrates that even judges with lower net worths can achieve extraordinary returns through selective angel investing.

Sector Specialization: Each judge’s wealth stems from distinct sectors, creating a complementary panel. Ritesh (hospitality & tech), Amit (automotive tech), Deepinder (food & logistics), Aman (audio electronics), Namita (pharmaceuticals), Peyush (optical retail)—this diversity ensures startups receive specialized advice from experts in their respective industries.

How Judge Net Worth Impacts Startup Confidence & Valuations

The net worth of judges significantly influences how startup founders approach pitches and negotiate valuations. A judge with higher net worth is perceived as having greater financial capacity to back larger funding rounds, leading founders to pitch more ambitiously. Additionally, judges with higher personal net worths often become founding investors in promising ventures, signaling confidence to institutional investors who subsequently fund these companies.

Empirical evidence from Shark Tank India shows that deals made by judges with higher net worths tend to attract subsequent institutional funding more easily. For instance, when Ritesh Agarwal or Deepinder Goyal invests in a startup, the founder’s ability to raise Series A funding improves significantly because institutional VCs view their investment as valuable validation.

Furthermore, judge net worth affects the psychological perceived value of mentorship. Founders receiving guidance from billionaire judges like Ritesh Agarwal believe the strategic advice carries greater weight because it comes from someone who has already navigated similar scaling challenges.

Success Stories: Startups Backed by These Judges

Zypp Electric (backed by Shark Tank judge): Valued at ₹220 crores during the pitch, Zypp Electric secured funding and scaled their electric scooter fleet from 2,000 to 21,000 units, achieving ₹300 crore revenue and operational profitability by FY24—a 13.6x valuation increase.

The Renal Project (backed by Namita Thapar & Aman Gupta): Expanded from 18 dialysis centers to 40 centers, with valuation growing from ₹17 crore to ₹72 crore—a 4.2x increase—while serving over 4,000 patients.

Winston (backed by Anupam Mittal): Achieved annual revenue of ₹60 crore post-Shark Tank, demonstrating the value of mentorship from experienced judges.

Frequently Asked Questions

Q: Who is the richest judge on Shark Tank India Season 5?

A: Ritesh Agarwal, founder of OYO Rooms, is by far the wealthiest judge with an estimated net worth of ₹16,000 crore—approximately $2 billion USD.

Q: What is the combined net worth of all Shark Tank India Season 5 judges?

A: The combined net worth exceeds ₹27,000 crores, making it one of the most prosperous investor panels globally.

Q: How accurate are these net worth figures?

A: Net worth estimates are based on public shareholdings (for listed companies), recent funding round valuations, and publicly available financial disclosures. Actual figures may vary depending on market conditions and unreported assets.

Q: Has any judge’s net worth decreased?

A: Yes. Deepinder Goyal’s net worth fluctuates with Zomato’s stock price, which experienced volatility post-IPO. Similarly, Ritesh Agarwal’s net worth correlates directly with OYO’s valuation in funding rounds.

Q: Which judge is the most active investor despite not being the wealthiest?

A: Anupam Mittal has made 250+ investments throughout Shark Tank India seasons, the highest among all judges, despite having a net worth of only ₹185 crore.

Q: Do judges use personal wealth for Shark Tank investments?

A: Yes. All judges invest from their personal funds during Shark Tank pitches, making these personal investments rather than corporate ventures. However, the amounts invested per deal are often small relative to their net worths (ranging from ₹25 lakhs to ₹5 crores typically).

Conclusion

Shark Tank India Season 5’s judge panel represents an extraordinary concentration of entrepreneurial wealth and business expertise, collectively worth over ₹27,000 crores. Ritesh Agarwal’s billionaire status as India’s youngest self-made billionaire stands as a testament to the potential of Indian entrepreneurs to build globally competitive enterprises. However, the real story extends beyond raw net worth—it lies in how these judges leverage their wealth, experience, and mentorship to transform ambitious startup founders into successful business leaders.

The judges’ diverse wealth sources—hospitality (Ritesh), automotive (Amit), food delivery (Deepinder), consumer electronics (Aman), pharmaceuticals (Namita), optical retail (Peyush), fintech (Azhar), beauty (Vineeta), and matrimonial services (Anupam)—ensure that India’s startup ecosystem receives mentorship across sectors. Their willingness to invest personal capital in early-stage ventures demonstrates faith in Indian entrepreneurship. As Shark Tank India Season 5 continues airing on Sony LIV, viewers will witness firsthand how judges with combined billions of rupees in personal wealth identify and nurture the next generation of Indian unicorns and global business leaders.

The wealth hierarchy among judges—with Ritesh at ₹16,000 crores and Anupam at ₹185 crores—reveals that in the startup ecosystem, net worth is just one measure of success. Anupam Mittal’s 250+ investments demonstrate that strategic thinking and selective deal-making can yield extraordinary returns regardless of personal net worth. For aspiring entrepreneurs watching Shark Tank India Season 5, the judges’ varied paths to wealth accumulation offer valuable lessons: success comes through identifying market gaps (Aman’s boAt), scaling with technology (Deepinder’s Zomato), patience and persistence (Ritesh’s OYO), and pioneering digital transformation (Anupam’s Shaadi.com). These lessons, transmitted through the show’s mentorship dynamic, have become as valuable to Indian entrepreneurs as the capital itself.

Asif Ali is an entertainment content creator and movie enthusiast at Movie Trend. I covers the latest movie news, OTT updates, and trending entertainment stories with a focus on accuracy, originality, and reader value.